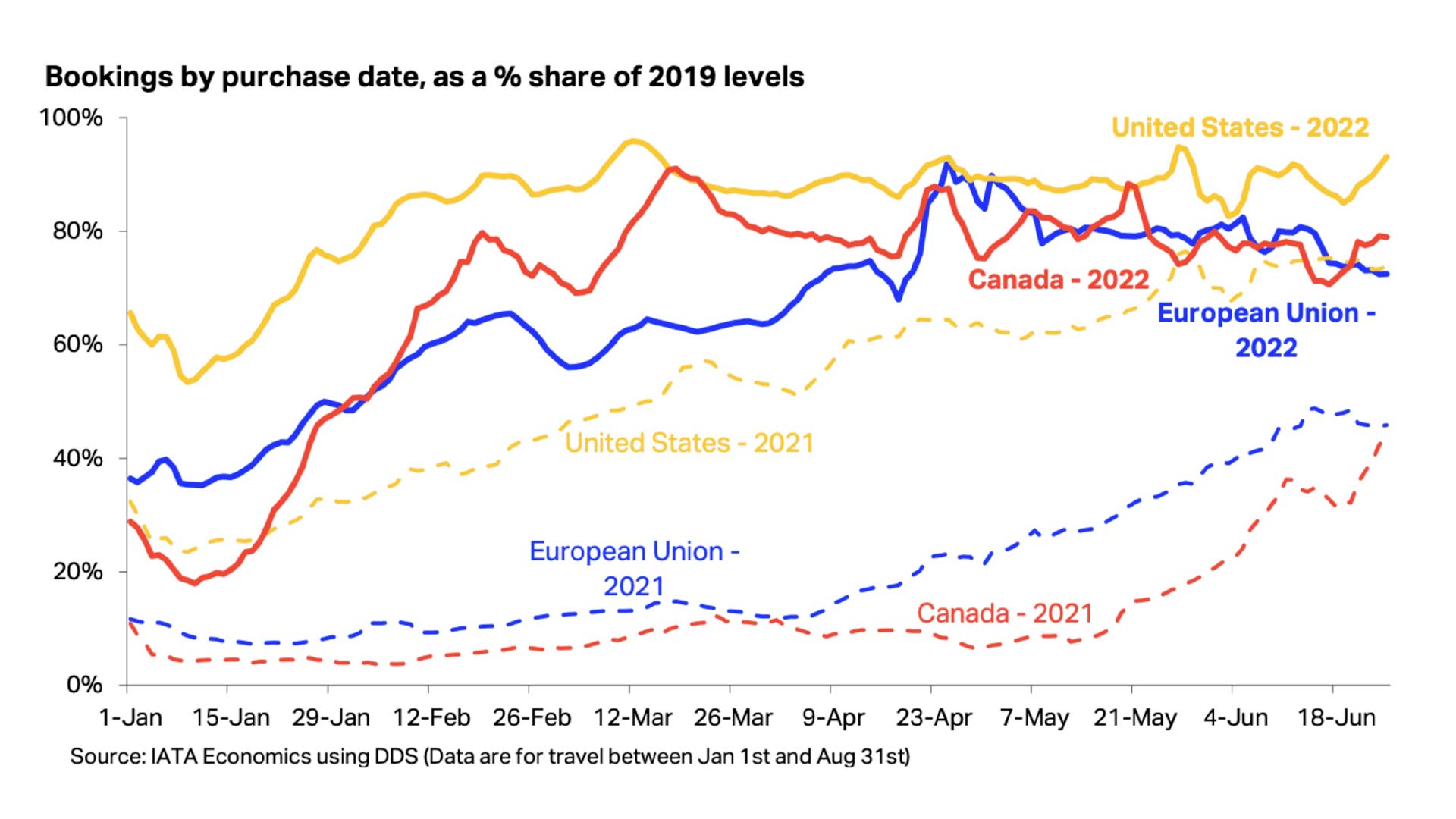

As attested by the airport queues and capacity cuts, a new chart from The International Air Transport Association (IATA) Economics shows the uptick in airline bookings in 2022.

The chart shows that the recovery is well underway in many jurisdictions, although showing some are faring better than others. The US is well ahead having benefitted from a strong domestic market in 2021 and as such seems to have coped better in ramping up capacity to adjust to the return of international travel and pent up demand for summer travel. IATA notes that this ramp up to a significant level of operations in 2021 has placed less stress on the industry this year. On the contrary, IATA shows by the chart that airlines operating in the EU and Canada have had to ramp up into a much greater proportional increase in demand this year. In early May, the gap between 2022 bookings and 2021 bookings (as a proportion of 2019 levels) was 66 and 70 percentage points for the EU and Canada respectively, whereas in the US this gap was only 26 percentage points.

The chart illustrates the scale of challenges that airlines and the wider air transport value chain are facing during the current northern hemisphere summer peak season in this phase of the recovery.

Meanwhile, the global shortage of airline and airport staff remains a major factor in many of the issues being reported this summer. Heathrow airport, which controversially imposed a capacity cut recently, has commented in its results announcement today (see Europe, Airports below for the full story) that a lack of airline ground staff is now to blame for the capacity constraints since the airport has hired 1,300 people in the last six months and states that it will have a similar level of security resource by the end of July as pre-pandemic.

The pilot shortage remains an ever-present issue for global airlines – exemplified by the recent news that Turkey was tightening conditions covering Turkish pilots who resign and move abroad to work for foreign airlines, as reported by Reuters earlier this month. Boeing’s latest Pilot and Technician Outlook (PTO) forecasts demand for 2.1 million new aviation personnel over the next 20 years to safely support the recovery in commercial air travel and meet rising long-term growth.

Boeing’s long-term forecast shows that 602,000 pilots, 610,000 maintenance technicians and 899,000 cabin crew members will be needed to support the global commercial fleet over the next two decades. The worldwide fleet is expected to nearly double and grow to 47,080 airplanes by 2041, according to Boeing's latest Commercial Market Outlook.

This year's PTO represents a 3.4% increase from 2021, excluding the Russia region, which is not forecast in this year's PTO due to sanctions that prohibit exports of aircraft manufactured in western countries and market uncertainty. China, Europe and North America represent over half of the total new personnel demand. The fastest growing regions are Africa, Southeast Asia and South Asia, with all three regions expected to grow more than 4% over the forecast period.

"As the commercial aviation industry recovers from the pandemic and plans for long-term growth, we anticipate a steady and increasing demand for aviation personnel, as well as the ongoing need for highly effective training," said Chris Broom, vice president, Commercial Training Solutions, Boeing Global Services. "Our customer-centric approach and digital expertise includes a commitment to delivering data driven, competency-based training and assessment solutions as well as technologies that meet the evolving needs of our customers."

Projected demand for new pilots, technicians and cabin crew by global region for the next 20 years is approximately:

| Region. | New Pilots | New Technicians | New Cabin Crew |

| Africa | 20,000 | 21,000 | 26,000 |

| China | 126,000 | 124,000 | 162,000 |

| Europe | 122,000 | 120,000 | 207,000 |

| Latin America | 35,000 | 35,000 | 48,000 |

| Middle East | 53,000 | 50,000 | 99,000 |

| North America | 128,000 | 134,000 | 173,000 |

| Northeast Asia | 22,000 | 24,000 | 38,000 |

| Oceania | 9,000 | 10,000 | 18,000 |

| South Asia | 37,000 | 34,000 | 43,000 |

| Southeast Asia | 50,000 | 58,000 | 85,000 |