AE81 Features

A window of opportunity

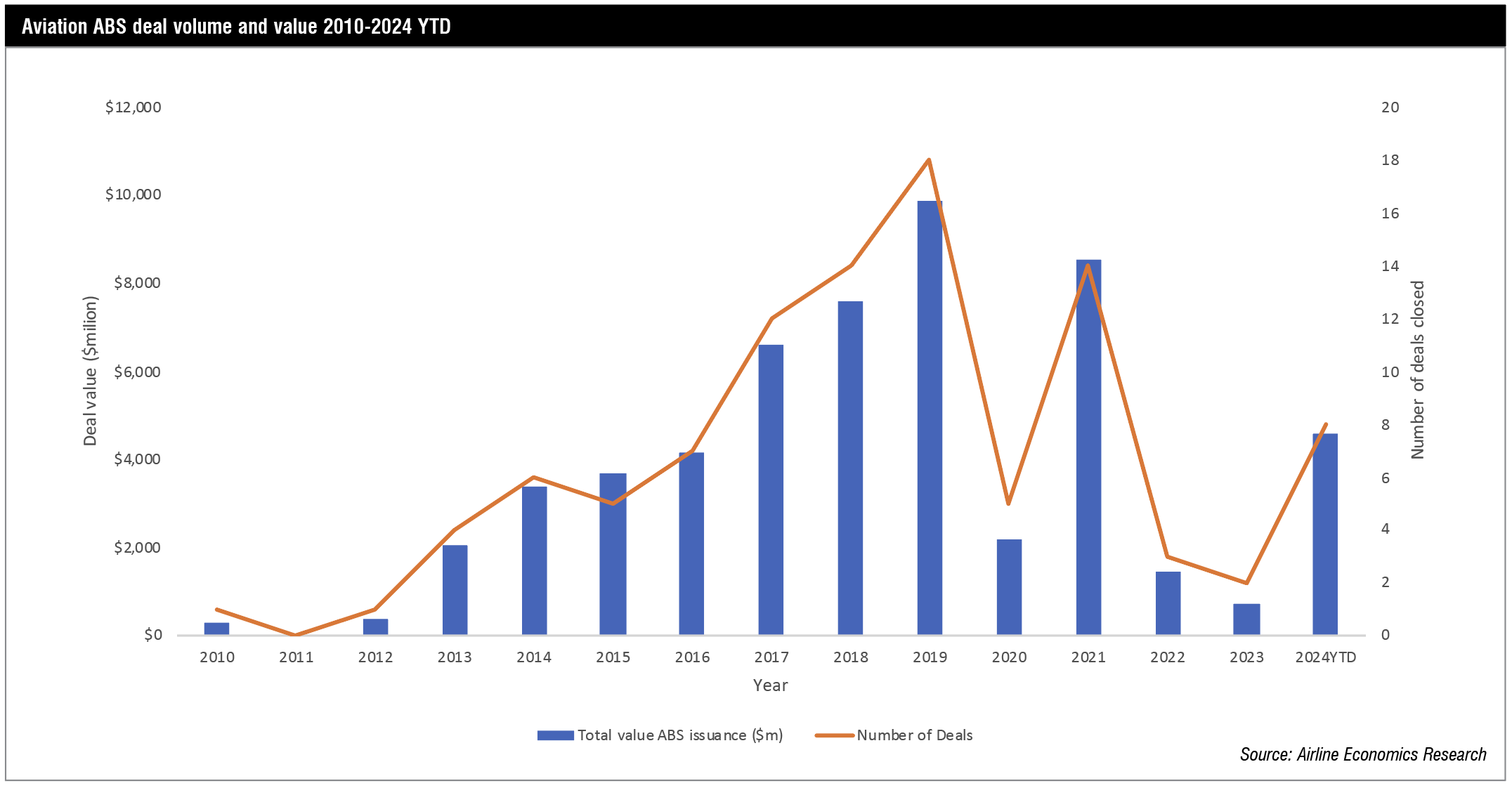

A viation asset backed securitisations (ABS) transactions have been a crucial funding vehicle for aircraft lessors, especially since the emergence from the global financial crisis. From 2012, aviation ABS issuance rose from a standing start with one deal from GECAS up to a peak of issuance in 2019 with 18 separate deals totalling $9.9bn and another strong year in 2021 where issuance rose to $8.5bn across 14 transactions.

The fallout from the global pandemic led to lessee defaults, deferrals, and restructurings – all of which damaged airline credit ratings and ABS cash flow. Added into the mix were rapidly rising interest rates, stubbornly low lease rates, and the Russia-Ukraine war that trapped a significant amount of leases planes in Russia. Such a perfect storm conspired to keep ABS issuance to a minimum in 2022 – with only two deals from regular business jet issuer Global Jet Capital and Carlyle Aviation Partners under its familiar AASET series – with portfolios of young, in-demand aircraft. In 2023, again there were only a few deals from engine lessor Willis Lease Corp – again under its established WEST series – and a rare aviation loan ABS transaction from Ashland Place. Simple economics and investor reluctance to put money into a distressed sector with a stalled secondary market effectively froze out this funding avenue for many lessors.

Evan Wallach, co-president of Global AirFinance Services – an analytics and consultancy firm that focuses on advising aviation ABS investors – pointed out on a Bloomberg webinar in May that investors were also deterred by a lack of current lease information for assets in ABS vehicles, he said that “better information would enable investors and other third party experts like Global AirFinance Services to build better forecast models, which would lead to better price discovery and a more efficient secondary trading market”.

In the second half of 2024, the economic environment has shifted. There is a more stable economic outlook, despite the ongoing war in Ukraine and a hot war in the Middle East. There is a less volatile interest rate trajectory, with signs that rates will fall albeit more slowly. Lease rate factors are rising steadily to meet the new higher rate environment – at least for new leases. Issues with the supply chain and production delays have intensified the rise in midlife aircraft values – especially older narrowbody equipment as they fill the gaps in supply from the manufacturers of next generation aircraft.

The robust demand for market aircraft in the secondary market was described as a “major tailwind” for the aircraft ABS structure, since they are typically backed by second generation aircraft technology, according to Reno Bianchi, co-president at Global AirFinance Services, speaking on the Bloomberg webinar. “Over the last 12 months, we have observed all trusts being able to remarket aircraft on the ground, either by selling at favourable valuation or leasing it at equally favourable term,” he said. He added that the extension of leases and the insurance payouts for leased aircraft held in Russia also had “a positive impact for several aircraft ABS” deals since they “enabled for some unanticipated accelerated debt repayment”.

Despite the more positive outlook for ABS assets, Wallach commented in a recent industry webinar that many existing aircraft ABS vehicles remained concerning since some 45 out of 55 issuers were behind in their scheduled principal amortizations. Wallach noted that in some pre-covid issues that the A notes were essentially acting as equity with the B notes “essentially long dated IOs [Interest Only or “Strip” bonds] without any principal repayment”.

Again, Wallach pointed to the lack of information to bond holders that has reduced secondary trading of B and C notes since no information is available on specific lease rates, maintenance reserves or return conditions. “Most of the lessees are second and third tier credits and as an aircraft lender, bondholders are indirectly taking the risks of repossession and deregistration in many different jurisdictions… [which makes it critical] for bondholders and new investors to properly model an aircraft ABS issue … to understand the rules of how collections are distributed through the waterfall each month,” said Bianchi.

Some ABS servicers have attempted to increase transparency for bondholders. In November 2023, asset manager Stratos launched an enhanced, free-to-access ABS reporting portal for its JOLAir 2019-1 ABS.

“We were prompted to launch this tool after many enquiries from investors struggling to understand the status of and value in various ABS portfolios, particularly since Covid,” said Gary Fitzgerald, chief executive officer of Stratos, at the time the tool was launched. “Over time we believe that increased transparency in the Aircraft ABS market should reduce the execution risk of new issuances and increase secondary trading volumes.”

Speaking to Airline Economics more recently, Fitzgerald expressed his disappointment that a year on this enhanced reporting feature had not been adopted for the more recent ABS issuances, which he says is likely because demand from noteholders had “trumped requests for better reporting and other improvements like quicker amortisation and higher post-ARD step ups”. To his knowledge, Stratos remains the only company offering this level of data. The company’s bonds are “trading at the very top of the market” shares Fitzgerald, adding that “several large noteholders have told us that this is proof that Stratos is considered “best in class” for performance and reporting on our two ABS deals”.

Although the more sophisticated noteholders are accessing the portal regularly, Fitzgerald notes that the since none of Stratos ABS deals have any default or payment issues and they do not have any material volumes of secondary notes available, the portal is not being utilised by as wide an investor base as hoped. Nonetheless, Fitzgerald adds: “The opaque reporting across our competitors remains a serious annoyance to many of the largest players, but it seems there is considerable reluctance to be more transparent – to the ultimate detriment to our industry in my view.”

Speaking to the Global AirFinance Services team in October, the question of transparency is one they are attempting to demystify for secondary market investors with their aviation ABS models. Wallach and Bianchi would like to see issuers or servicers take responsibility for updating the model presented at offering stages annually or biannually, or at least when the leases begin to turn over but recognise this would be a significant undertaking. “This sector amazes me that is trades without any real analytics,” says Bianchi. “The model at the launch is never updated so investors have tomake a lot of assumptions on what may happen to the collateral pool. I can sympathise that no one wants to own such a responsibility because updating the model is a time consuming and complicated process.”

More ABS deals are expected to emerge before the end of the year and into next. With such robust demand for lift, leasing companies have been filling up their existing warehouses with as many aircraft as they can source to take advantage of the uptick in demand but for older vintage aircraft some warehouse facilities may not have the flexibility to allow for older assets or engine assets, which some lessors are also turning to as demand exceeds supply.

Since the pandemic warehouse facilities have supplied a crucial line of funding for acquisitive lessors but many are expiring or are no longer fit for purpose.

“Many warehouses issued in 2021 came up for renewal in 2023 and although many banks were very supportive and extended facilities for another year or two, issuers have taken advantage of the current window of opportunity to refinance those warehouse in the ABS market this year either because they wanted to add more and were coming up against capacity issues,” explains Vinodh Srinivasan, managing director, co-head structured credit group at Mizuho Americas.

Warehouse financing can be both expensive and restrictive in terms of the number and types of assets being acquired. They typically have been used as vehicles to acquire assets quickly before seeking longer term refinancing for a portfolio in the capital markets. When the post-pandemic operating environment made it unaffordable to refinance aircraft assets in the ABS market, warehouse facilities from commercial banks were more attractive and relatively simple to secure especially for premium rate credits with many lessors closing large warehouse deals – some above $1bn – with much more flexible parameters than were closed pre-Covid.

SKY Leasing closed an upsized $1.2bn warehouse facility last year, which provided significant flexibility with respect to asset eligibility for the lessor. SKY turned to the ABS market in September with a new single A tranche ABS transaction – the $569.5 million SLAM 2024-1 – which will be used to refinance a portion of the warehouse. MUFG and Deutsche Bank were joint structuring lead and joint lead bookrunners.

SKY is one of several issuers to come to market in September 2024 although the aircraft ABS market was effectively “reopened” by Carlyle Aviation Partners with AASET 2024-1 in June this year, with was followed by a second issuance AASET 2024-2 in September. Apollo PK Airfinance was another dual issue with an aviation loan ABS issued in June PKAir 2024-1 and again in September with PKAir 2024-2.

Also in September, regular issuer Global Jet Capital went to market with another $617 million business jet ABS – BJETS 2024-2 – with Pimco and BBAM also entering the market with new ABS deals in their Navigator and Horizon series, respectively.

All of the ABS deals to come to market in this window of opportunity between the Federal Reserve lowering interest rates and the US election have similar characteristics – they are all repeat issuers so investors are familiar with the servicers and are comfortable with their prior track record of performance.

“With an aircraft lease securitisation you are not going to get to triple A tranches, they are likely to remain most senior single A tranche issuances,” says Mizuho’s Srinivasan. “The structures [of recent bond ABS deals] are largely the same as they were before but there is a little more focus on amortisation and prepayment penalties because investors don’t want to be prepaid. The single A tranches LTVs are reaching 65-68%, and about 78% on triple B, which is back to where single As and triple Bs were before. But there is still not enough cash in these deals to structure a C tranche.”

One investor describes the ABS market as reopened but in a “much more stunted form, with only A tranches with very young aircraft with long leases”. He argues that the issuers and structuring banks “are creating optionality, not because it is economically attractive for them”, adding that it remains very expensive to issue only senior classes within a securitisation structure. “Current issuers will be hoping that the market will open up at some point and they can return to investors with subordinated tranches,” says the investor. “The market is open now and it gives bankers an ability to get investors excited about the asset class again but it remains very proscribed, which reflects the concern many investors have over the risk profile of the sector and the interest rate environment. It takes time for leases to be written at a level that makes sense.”

Given the value of midlife assets – as discussed above – it may be surprising that few midlife ABS deals have come to market since such an in-demand portfolio should support better returns for the B and C notes. “To me that shows there is still reticence among providers of equity capital for midlife lessors and in the bond markets, where investors remain very worried about midlife assets,” says one investor.

More aviation ABS are scheduled to be issued before the end of the year and into the first quarter of 2025 and bankers are optimistic that investors are once again feeling more confident of returns in the sector. But as one investors says, it is the bankers’ role to “sell sunshine” observing that ABS deals remain an expensive form of financing and that they only really make sense when you can issue subordinated tranches. “The Bs and Cs provide the lessors with the arbitrage between what they may have paid for those assets and the appraised value of the portfolio,” says one investor. “In some cases they can get a good part of their capital back; that’s the real benefit because otherwise all of that documentation and legal expense in setting up these entities is expensive and there are often much more attractive options for raising funding.”

The recent aircraft ABS deals to come to market are all from repeat issuers that have the advantage of experience with the process, template legal documentation, and long standing investor relationships, which negates some of those challenges with this sort of financing product. And like the investor suggests, these deals will have been issued with the view to adding subordinated tranches in the future. Recent issuers are adding more tranches but they remain in the senior classes. In July, Carlyle Aviation added $321.195 million A-2 class of notes to its initial $428.05 million single A-1 notes, AASET 2024-1, issuance in June. And as previously mentioned, Carlyle added a B tranche in its second offering this year AASET 2024-2. Goldman Sachs was the sole structuring agent, global coordinator and joint lead bookrunner.

Despite the challenges, bankers remain optimistic that pricing will continue to strengthen and that lease rate factors in securitised portfolios will be able to sustain subordinated tranches of notes.

“We are in a more constructive rate environment,” says Srinivasan. “Given five years rates at 3.5% and a 200bps spread will be an all-in yield of about 5.5% for the single A tranche, which is a lot better than we have seen in a long time. But lease rates take a while to readjust. Any renewals from the past 12 to 24 months have been reset at higher lease rates so that takes a while to move through the system. Between that movement and interest rates now falling – the prediction is that the Fed will announce another 50bps cut over the rest of this year and maybe another 50bps next year – which would make it a lot more attractive for aircraft ABS issuers to come to market. In the next 6-12 months, we could see single A tranches price down to high 4% to 5% yield which then makes room for a C tranche. And hopefully – once that new environment is set – we can start selling E notes as well.”

In May, during an ISTAT Learning Lab presentation, JPMorgan’s Mark Streeter said that although he disliked the aircraft ABS product where he said investors seemed to get “perpetually burned” he agreed that E note sales would resume “at some point” and with different terms. When it does come back, he said, and its strength “would be a function of the entire ecosystem having more aircraft to trade and with Boeing and Airbus delivering more airplanes”. In response, fellow speaker Betsy Snyder, who has rated lessors for many years in her previous role at S&P, agreed, noting the shift in focus of ABS transactions to loan portfolios rather that operating lease portfolios, highlighting the aviation loan ABS from Ashland Place late in 2023. PK Airfinance has capitalised on the attraction of aviation loan books in the securitisation market with two deals this year – PKAir 2024-1 and PKAir 2024-2. Both deals featured multiple tranches and were oversubscribed.

Some of the more recent deals offer ABS paper with a final maturity of 20 years. With this the question of an aircraft’s economic useful life has reemerged as a matter for debate. Despite aircraft still being depreciated using a straight-line methodology over 20 years, there has been a growing trend for aircraft to be retired earlier in light of the advances in technology for new aircraft and engines. “Everyone accepts that an aircraft can be operated for 25 to 30 years if properly maintained but the economic useful life of an aircraft has decreased as the pace of technological evolution has accelerated,” says Bianchi. “The useful life of an aircraft today is more like 15 to 20 years. Wallach commented: “By extending the bond amortization schedule out to 20 years secured by aircraft that may already be four years old, investors are taking the risk of those aircraft operating past 25 years to be able to repay the paper.” Others in the industry are adamant that the economic useful life of an aircraft remains at 25 years and that the issue does not impact aviation ABS structures. One banker commented: “The vast majority of aircraft ABS in the last decade have 20-25 years legal final maturity so there are no changes there. They all have circa seven years expected maturity after which there is cash sweep and coupon step ups.”

Many more issuers and bankers share a more positive view of the sector and many are considering – or are even in the process of – bringing new portfolio deals to the ABS market. Castlelake, which was a regular ABS issuer, secured a $1bn term loan facility to acquire more assets in September. The term loan – provided by Deutsche Bank, Goldman Sachs, BNP Paribas and MUFG – was designed to provide longer term flexibility compared to short duration warehouse facilities.

For Joe McConnell, partner and deputy co-chief investment officer at Castlelake, accessing bank debt was the preferred funding option in the current market. “We have seen a number of commercial banks that have left the aviation sector and those that remain appear to be growing their exposure to aviation but they are opting for counterparties that have performed through the pandemic, that they really trust,” says McConnell. “So we are increasing our market share with banks, and based upon our relationships we were able to secure a billion dollar term loan.

McConnell went on to expain that the loan is very similar to a warehouse and it is designed to allow for an ABS takeout. “It is something we are talking about now the market has reopened,” he says. “As some point in time we expect to use the ABS market again. We believe it is a great product and can be an efficient tool for helping us to continue to scale our business."

McConnell also noted the continued challenge posed by lease rate factors compared to interest rates. “We believe a number of the more recent ABS deals of the ABS deals have had a lot of young aircraft lease rate factors that we don’t believe are that attractive and with interest rates a lot higher, debt service coverage ratios are squeezed,” he says. “The B and C market appears open today but it comes down to whether you have enough cashflow to demonstrate to rating agencies and debt investors that you can service the debt and at the right price. Any ABS issuance for us will be a question of the portfolio and how it compares to the bank financing market. We are are not going to force an ABS just for the sake of it. We will watch how the market evolves.”

There seems no doubt now that the ABS market will come back, altered perhaps, but it will continue to provide a viable funding solution for midlife aircraft lessors. The aircraft ABS product has proven its resilience. After the global financial crisis, the “dead” ABS market reopened tentatively in 2012 with the second ever Willis Lease Finance “WEST II” engine securitisation deal, which paved the way for General Electric Capital Corp’s (GECC) $1.7bn ABS deal led by Goldman Sachs. GECAS followed a year later with a $557 million ABS deal, then by Avolon’s Emerald Aviation Finance transaction and the Fan engine securitisation from GECAS. As the graph shows, ABS issuance has ebbed and flowed with market forces as well as economic and geopolitical events but it has proven its value as a powerful financing tool for aircraft lessors time and time again and shows no sign of exiting the stable of aviation capital market products.

We're Social