Airline Economics Growth Frontiers India was held against the backdrop of a jumbo order of 470 aircraft from the revitalised Air India. The conference was abuzz with the discussions of the record order, the proposed maintenance of such a large fleet as well as how the aircraft could be funded and the broader aviation ecosystem in India and much more. Overall, the tone of the first Indian conference was full of optimism and hope for the post-pandemic recovery.

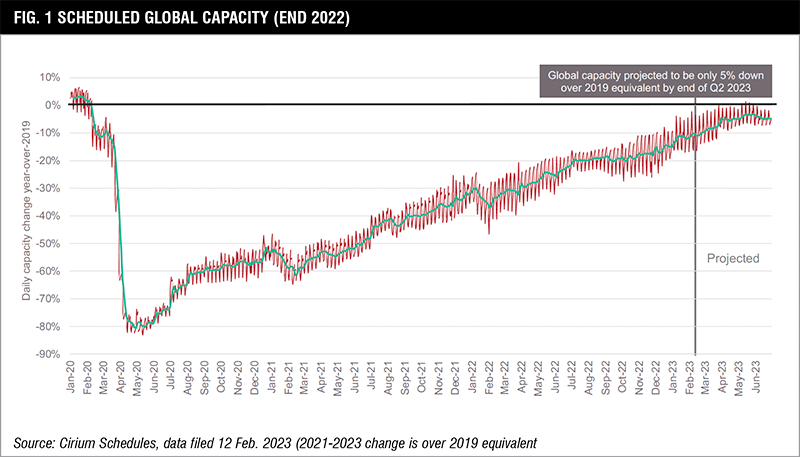

The opening presentation from Lalitya Dhavala from ASCEND by Cirium informed delegates with her data-driven statistics comparing the overall recovery in Asia Pacific (APAC) region with the global aviation market outlook. The global capacity clearly shows a steady recovery from the big drop due to COVID in 2019; post pandemic the recovery has been steady with only a little volatility reflecting the resilience of aviation industry. As per Cirium data, by February 2023, global capacity was almost 95% of pre-pandemic levels (Fig. 1).

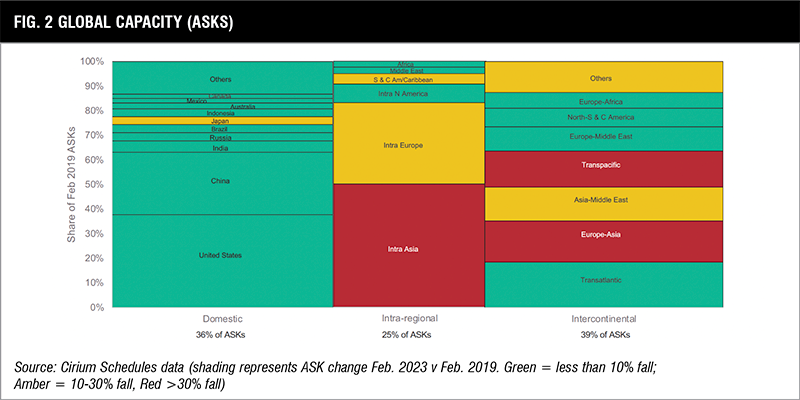

Going ahead, the chart from Cirium (Fig 2) shows the robust domestic aviation recovery across the globe – the green indicates less than 10% difference to 2019 levels. Except for Japan, more or less all the domestic markets are recovering well. In the intra-regional segment, intra-Asia is in the red category due to China lifting its restrictions rather later than other countries. Intra Europe also shows a slow recovery due to the chaotic summer with passenger demand returning in full swing sending the airport and infrastructure reeling under the pressure. On the inter-continental side, Europe, Africa, North America, had a head start while the Asia-Middle East markets were affected due to the late comeback of China.

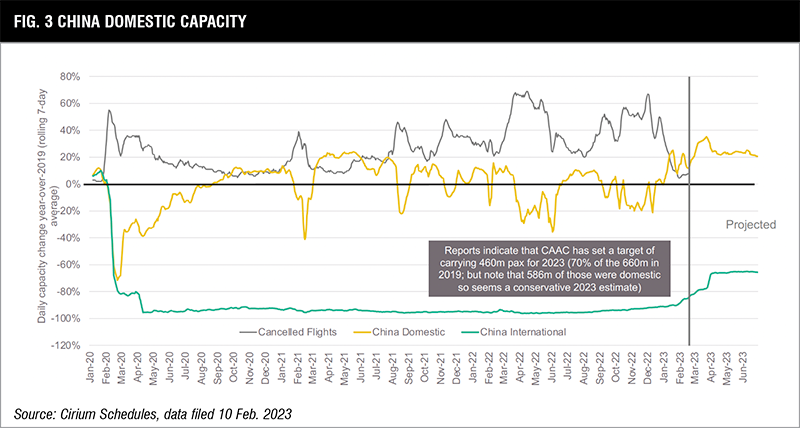

Cirium data clearly reflects the positive outlook in the China domestic market (see Fig 3). However, the domestic recovery has been volatile due to regional lockdowns, quarantines, shut-downs. The black line indicates a high level of cancellations, almost 40-60% due to constantly changing COVID 19 rules and regulations. As anticipated, China markets did not bounce back as quickly post the lifting of pandemic restrictions mostly attributed to conscious scheduling by airlines as they continue to add capacity with demand.

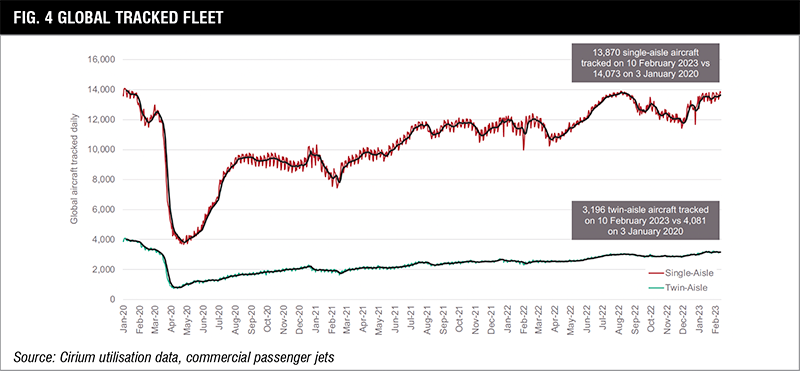

The global tracked fleet showed that 2023 will be the year of recovery and the graph (Fig 4) shows that the fleet is now just above 2019 levels, by a little over 1%. The single-aisle fleet reflects a stable outlook while the double-aisle is just about catching up, showing good utilisation on both narrow and widebody aircraft.

The strong recover in passenger numbers has brought back demand for aircraft, and the number of aircraft in storage continues to decline with only 340 single-aisle aircraft currently in storage excluding the Russia-managed fleet.

The Cirium data shows about 100 twin-aisle aircraft in storage with the numbers declining steadily. This demand reflects an upward sentiment on lease rates. One of the more interesting things about the market recovery is that it is being led by older generation aircraft, 10-year-old aircraft are performing much better in terms of values and lease-rates, as per Cirium.

Talk of the town

The recent order of 470 aircraft has been the talk of the town. Followed by the in-depth analysis of Indian and global aviation recovery, the on-stage discussion moved to the big order coming from Air India and the expectation of many more new aircraft orders to follow from other Indian carriers. The most common question circulating the conference was the validity of this jumbo order, given the history of Indian aviation.

Ram Shankar of AeroDef Labs, gave a typical example of comparing Indian aviation today to that of a decade or a couple of decades ago. “Indian civil aviation sector today is much better placed that it ever was with India making some phenomenal progress in terms of orders, regulatory policies, skill set perspective etc,” he said. “Today the talent pool is ready to take on the challenges of global aviation industry.”

Marc Baer, president, Griffin Global Asset Management, expressed his confidence in the resurgence of the Indian market: “The recent order of 470 aircraft certainly qualifies for glitz and glamour and India is currently enjoying the limelight. The value proposition is definitely there, as all the 470 aircraft will be latest, new technology aircraft that will replace the older generation aircraft. Air India is poised to become a dominant long-haul carrier than before.”

Baer noted that challenges remain: “Although India is one of the fastest growing civil aviation markets, there are multiple challenges when it comes to aircraft repossession in India. However, if we look at the better picture, the Indian government has taken significant steps to encourage the Foreign Direct investment in the country. Right now, we should take a step back and look at the reforms that are being rolled by the Indian ministry for ease of doing business for foreign lessors,” he added.

The current deregistration process in India is very streamlined. The Directorate General of Civil Aviation (DGCA) in India is mandated to deregister the aircraft within five days, right to issuing the export certificate.

Speaking on the subject of engine leasing in India, Vassil Vassilev, vice president sales & marketing – CIS, India & Turkey at Engine Lease Finance (ELFC) gave an optimistic forecast on India. “Every market has its own uniqueness. Engine leasing business in India is challenging from the airlines as well as manufacture point of view, which brings the need of spare engines,” commented Vassilev. “Indian markets have enormous potential; we are seeing tremendous recovery in Indian markets. There is optimistic GDP projection in India, which essentially co-relates to air travel making air travel more affordable.”

He further added: “The government as well as the stakeholders are trying to create an engine lessor friendly eco-system in India. OEMs are of the opinion that the COVID-19 pandemic has given the chance to airlines to access and rethink their plans and strategy, India’s focus on the regional connectivity scheme, traffic coming back in leaps and bounds, increasing load factor and mind-boggling population of India, new airports coming up every week. The OEMs are loving India for the sheer growth in the civil aviation market.”

While giving a presentation on Embraer’s overview and outlook, Adam Young, marketing director - Asia Pacific for Embraer Commercial Aviation, dived straight into Embraer’s global forecast in 140-seat segment reflecting a demand of about 11,000 aircraft worldwide.

The demand is spilt between growth opportunities at 43% and replacement opportunities at 57%, said Young. He added that although Embraer’s focus has always been towards the west, he noted that the demand from the East was rising very quickly. South Asia and India, in the next twenty-year Embraer outlook will match the new aircraft deliveries in the traditional stronghold of North America, he said, it will be underpinned by rightsizing, niche market services and most importantly fleet diversification.

Embraer bifurcates Asia-Pacific (APAC) into China and the rest of APAC. As per the chart (Fig 7), Embraer predicts about 1735 new deliveries in APAC, excluding China of which a major chunk of 515 deliveries is expected from India.

Paul Goodfellow, head of risk & restructuring at asset manager Stratos, kicked off day two of Airline Economics on a positive note throwing light on the steadily rising domestic civil aviation sector in India and how investors in India as well as the world are eyeing India with interest with regards to aircraft financing.

Goodfellow spoke in depth on the investor perspective on Indian aviation, the risks, challenges and the relatively high returns of investing in Indian airlines, and what can encourage investors to come to invest in India. He also numbered the reasons that hold back lessors and financers from investing in India as there are fewer options in terms of cost-effective financing solutions and available lease rates.

Speaking of the ways to encourage investors to invest in Indian aviation especially in airlines, Goodfellow stressed the need to observe the impact of more universally accepted practices, most importantly better yield management practices in line with international markets and certain off-putting practices like tax on fuels, GST on rentals etc. that makes running an airline in India both complicated and costly.

“India’s has so far fared poorly in terms of Cape Town compliance destination and world repossession index, but things are changing as we think of investor perceptions,” Goodfellow concluded.

While speaking on the regulatory aspects of aircraft financing in India, Dr Vandana Agarwal of the Ministry of Civil Aviation, India, focussed on the birth of GIFT city or the IFSC that has plans to build and offshore Indian regime that has two aspects: incentivising the legal and commercial innovations, and bringing more financing of India aircraft back into the country. Some 80% of Indian aircraft have operating leases mostly all financed oversees leading to a huge amount of international law impingement on Indian aviation. This was one of the main reasons why GIFT city came into existence to be in sync with the dynamism of the international contracts and with time offer those best-in-class practises.

In a fireside chat Shashank Jain, vice president and head, legal, at Vistara - TATA SIA Airlines, explained how finance leasing will be a more popular choice for Indian airlines in near future. He also spoke more on the risk-reward situation in aircraft leasing based on the priorities of the airline.

“The different risk appetite of lessors, depending on going for mid-age aircraft or newer jets.” He went ahead differentiating the perspectives of lessors and airlines while buying an aircraft. “Lessor refrains from investing in a new product immediately, as the risk is too high, they need to place the aircraft on lease as soon as possible. But an airline perspective is different, an airline on the other hand opts for newer aircraft, putting the risk on the OEM.”

Arun Kashyap, chief technical officer at Air India threw light on the maintenance, repair and overhaul (MRO) plans of the new Air India order going ahead. “Engineering is the backbone of any airline,” he said. “The airline will engage with AIESL MRO, see what they can bring to the table. The airline is also developing its in-house MRO capabilities plus we will also look at third party MROs. The airline is currently developing a strategy.”

“We cannot afford to go wrong and we have to make sure everything is right. The team is on track and with help and support from the OEMs, we are more excited than ever,” he added.

India is currently the world’s third-largest civil aviation market and has big ambitions to expand air connectivity, which is still beyond the reach of a significant chunk of the population. Experts feel that India could emerge as the top aviation market globally by the turn of the decade, surpassing the United States and China on most parameters.

Right now, India’s aviation sector is at an inflection point between infancy and just having entered the growth phase, and it has immense potential in the years to come. Over the past six years, India’s domestic passenger traffic has grown at a compound annual growth rate (CAGR) of around 14.5%, while international passenger traffic has increased by a CAGR of around 6.5%, as per the ministry figures.

The Ministry of Civil Aviation in India has been a strong pillar of support to funnel this growth. With the rising demand for air travel in India, a significant push in aviation infrastructure is also being seen. Passenger handling capacity at airports at the country’s six major metropolitan cities is likely to expand to 320 million per year in the near future and to 500 million per year over the next few years. The government wants all six metros – Delhi, Mumbai, Bengaluru, Hyderabad, Chennai, and Kolkata – to emerge as major international hubs for air travel.

Even as India’s aviation sector registers growth on most fronts, there are some of challenges that the industry needs to be mindful of. These include building “ahead of the curve”, world-class aviation infrastructure, the inability of global OEMs to keep up with India’s rapidly rising demand for aircraft and components leading to supply chain woes, a lack of MRO facilities of significant scale within India, cost effective financing/investing options, or clarity on aircraft repossession. The Indian government is tackling the challenges one-step at a time to develop a sound civil aviation eco-system in India.