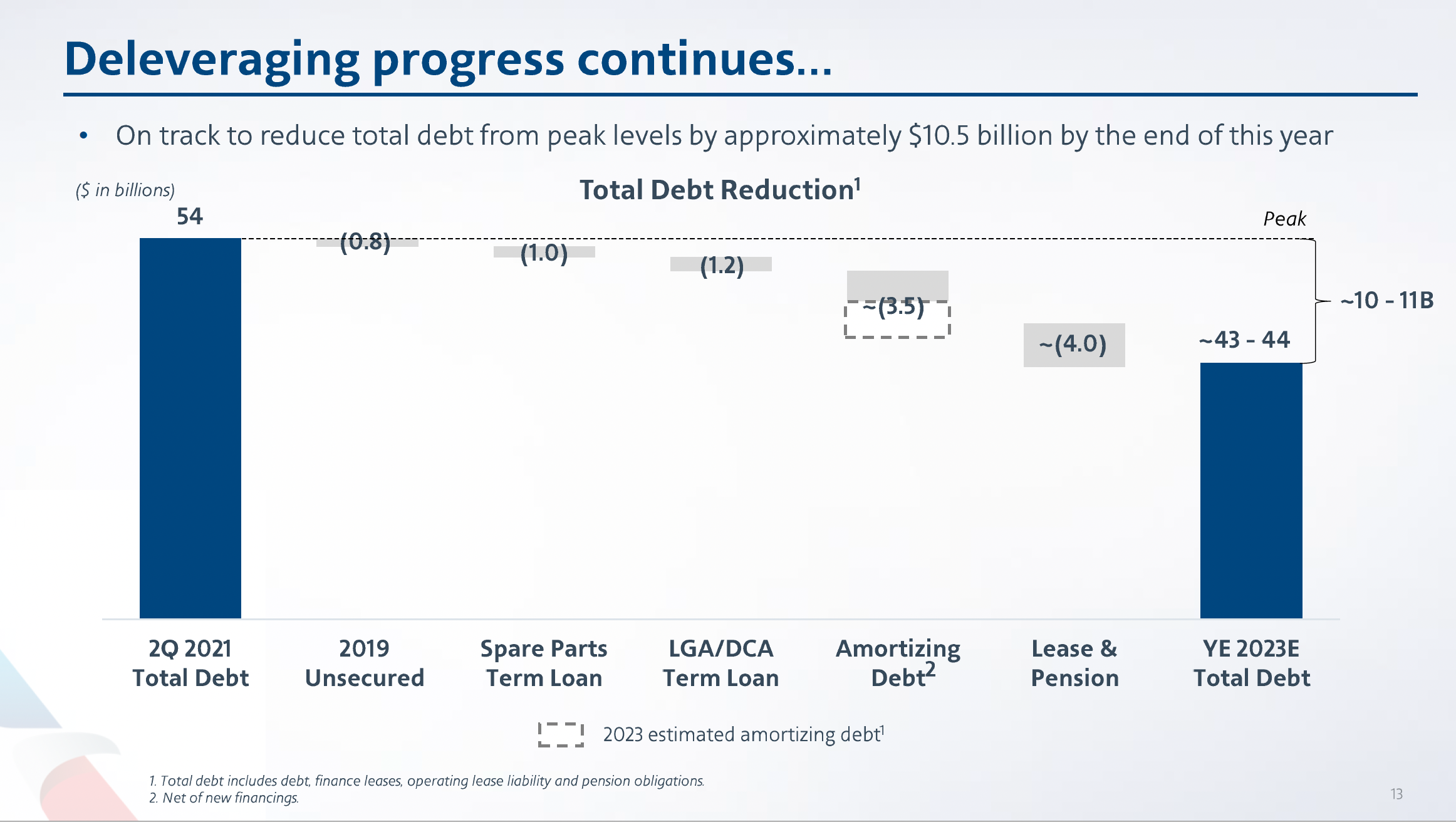

American Airlines took on additional debt during the pandemic, with its debt level peaking at over $54bn in mid-2021 (inclusive of debt, lease liability and underfunded pension position). As the industry has recovered and airlines, especially those in the US market, have replenished capacity and returned to generating revenue and even profit in some cases, the focus quickly turned to de-leveraging.

American laid out its plan to de-lever its balance sheet in Summer 2021. On its second-quarter 2021 results earnings call in July 2021, American announced its intention to pay down $15bn of gross debt by the end of 2025 through scheduled amortisation of its existing debt, and using excess free cash flow to opportunistically pay down pre-payable debt. With a liquidity level of more than $21bn heading into the third quarter of 2021 and normalised levels of planned capital expenditure given the airline had completed its fleet modernisation programme, American was in a position to begin to pay down debt in a significant way.

American kicked off its deleveraging plan with the repayment of its $950 million spare parts term loan in July 2021, almost two years ahead of its scheduled maturity in April 2023. Although the loan had a low coupon of Libor plus 200 basis points (bps), prepaying the loan early, in then-CFO Derek Kerr’s words, “set the stage” for future optimisation of the airline’s unencumbered collateral pool while also improving American’s first lien capacity.

American continued deleveraging throughout the remainder of 2021, paying off its 2013-1 EETC B tranche, and into 2022 with the paydown of its $750 million senior unsecured notes that matured in June 2022 and the repayment of a $1.2bn term loan, which was secured by domestic slots, in December 2022, a year ahead of its scheduled maturity.

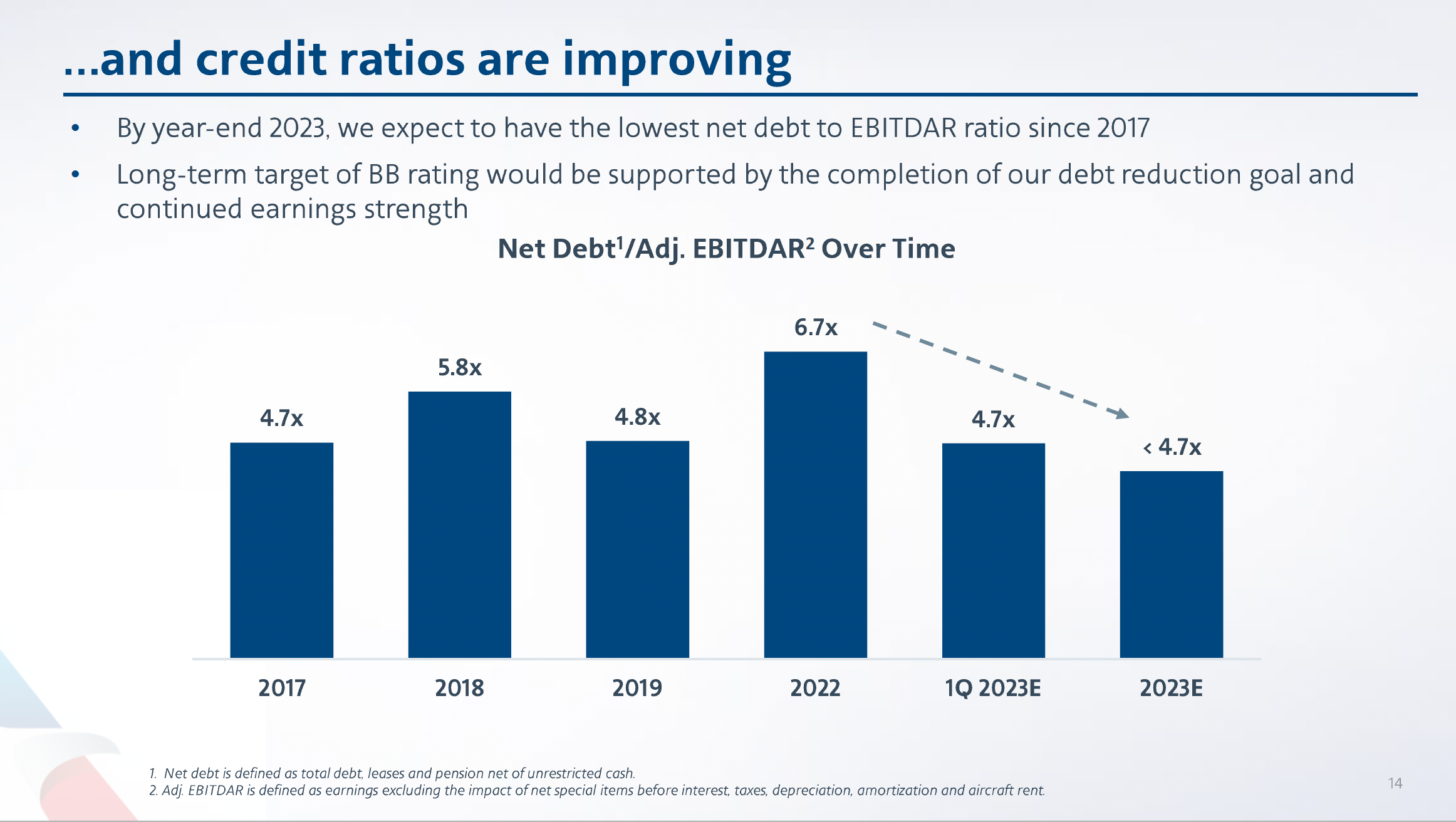

American reached the midway point of its debt reduction target of $15bn only 18 months into its deleveraging programme. By the end of this year, American expects to have reduced its total debt by between $10-11bn from its 2021 peak. Speaking on an earnings call in April 2023, new CFO Devon May announced that at the end of the first quarter of 2023, American had lower net debt and a better net debt to adjusted EBITDAR ratio than it did at the end of 2019.

However, American’s $9.3bn 2025 debt tower remained a concern for investors and rating agencies. At the JP Morgan Industrials Conference in March 2023, Meghan Montana, said that “all eyes are on opportunistic ways to manage 2025” and that the team was focused on the efficient reorganisation of its long-term capital structure.

Speaking to Airline Economics following the closure of a new $1.75bn refinancing of the airline’s South American slots, gates and routes-backed term loan in February 2023, Montana reiterated the airline’s commitment to paying down debt while explaining the reasoning behind the deal. “The refinancing does not reduce debt, but it does smooth out our maturities by extending a facility that we wanted to remain part of the permanent capital structure,” she said, “which forms part of our overall balance sheet improvement plan.”

“BB flat remains our sweet spot target. With EETCs and the new loyalty structures we can notch upwards to investment grade to access better pricing pretty consistently.”

Meghan Montana, Senior Vice President and Treasurer, American Airlines

Montana explained that the team had found a “constructive window” in February 2023 to “reprice and extend” the term loan, which was due to mature in 2025. American divided the term loan into two new parts – an amended $1bn term loan B and a $750 million bond backed by the same collateral pool, with a combined maturity of 2028.

As well as smoothing out the airline’s maturities in 2025, the transaction was viewed as a credit positive by ratings agencies since it reduced the 2025 maturity tower by close to 20%, to $7.3bn, and also demonstrated American’s continued access to the capital markets. In its rating action commentary on the refinancing, published this February, Fitch Ratings revised American’s Outlook to “Positive” from “Stable” and suggested that American could even “warrant a higher rating in the next six-to-12 months absent weaker-than-expected results potentially driven by macroeconomic factors.” In late March, Standard & Poor’s (S&P) followed suit and raised American’s outlook to Positive and affirmed is B- credit rating. S&P also commented that it could raise its rating within the next 12 months “if we gain further conviction that American will meet our estimates for its [funds from operations] FFO-to-debt ratio to exceed 10% in 2023 and 2024.”

At B-, American’s credit rating is lower than its peers (Delta Air Lines is rated BB+/Negative by Fitch while United is B+/Stable). Fitch states the lower rating is due to American’s “historically more aggressive financial policies and higher debt balance,” which had already increased substantially before the pandemic due to its fleet renewal costs and share repurchases. The Positive rating reflects American’s demonstrated commitment to reducing debt and turning its free cash flow into positive territory as well as its reorganisation of its long-term debt stack that will free up unencumbered assets, creating even more options to extend maturities and pay down debt.

In a Bloomberg article in March, American’s new CFO Devon May publicly commented for the first time on the airline’s ambition to increase its credit rating from B- to BB over the long term. Increasing its credit rating one notch will among other things assist the airline in achieving more competitive pricing in the bond market. Bloomberg states that BB-rated borrowers pay on average about 7%, whereas B-rated borrowers pay closer to 9%. Investment-grade borrowers command much better pricing but that’s not a goal for American. In fact, as Montana explains, the airline is happy to remain at a just sub-IG level.

“BB flat remains our sweet spot target,” she says. “With EETCs and the new loyalty structures we can notch upwards to investment grade to access better pricing pretty consistently. So we are borrowing at investment grade but the airline is just below that. This provides us with much more flexibility to navigate the ups and downs that this cyclical industry is prone to experience.”

During the pandemic, all airlines were downgraded by the rating agencies, but it could be argued that lower-rated airlines like American were more punitively treated than higher-rated peers. “American was BB- before the pandemic and was downgraded three notches by Fitch and S&P and two notches by Moody’s, while our competitors that were only one notch above us at the outset of the pandemic were treated more leniently,” says Montana. “There is clearly a break point where rating agencies see recovery and leverage risk in a downside case scenario.”

Clemens Metz, Managing Director of Corporate Finance and Treasury at American, adds that the quantum of debt and financial performance an airline needs to achieve to be rated investment grade is “pretty significant” and notes that he believes there are diminishing returns unique to airlines. “While more notches up certainly helps market access and pricing, given the attractiveness of the assets we finance, there are diminishing returns,” he says. “If you go into investment-grade territory in a cyclical industry like ours, it can be difficult to navigate collateral and covenants, for example, but also the investment grade unsecured market can be a tricky one for airlines. It’s not always available. We like to hit it whenever it’s there, but to be much more reliant on that market would be challenging. Given these challenges, we like the just below investment grade zip code from a corporate perspective and the EETC structure allows us to issue IG debt.”

American is paying down debt at a steady rate and even through amortisation alone, the airline will pay down $3bn this year and has no further large maturities now for 2023. “Each dollar we pay down frees up high-quality borrowing capacity,” says Montana, adding that free cash flow generation will be used to service those debts. Although the airline still needs to finance some new aircraft deliveries this year and in 2024, its capex requirements are at lower levels relative to preceding years, given it re-fleeted heavily after the merger and now has the youngest fleet among US network carriers. The company has guided to full-year aircraft capital spending of only $1.5bn in 2023, levels that are significantly lower than its main peers who have heavier delivery schedules. Deliveries are scheduled to increase in 2024 with American set to take more 737 MAXs and 787s, but total capital spending is expected to remain manageable (see Limited capex requirements chart below).

American Airlines Debt Stack and Reduction Plan through Year-End 2023

source: American Airlines

American is looking at a number of options to finance its 2023 deliveries and went out with an RFP for 12 MAXs. Concerns over delivery delays have made more structured financing less attractive due to negative carry concerns, explains Montana. “We love the EETC product, but we are looking at more bilateral products for these aircraft because we don’t want to be managing negative carry in this rate environment and I don’t want to have sticky expensive financing in place and then the aircraft fails to be delivered on time. We have looked largely at finance leases – which many lessors are pitching right now – and bilateral mortgages that have no market facing risk. We can be very nimble now and have the time to explore deals with existing partners that have appetite to refill their books.”

As Montana has already stated, the team plans on being nimble and flexible in the approach to the 2025 debt stack. Despite the strong demand environment reported by US carriers in their recent results for the first quarter, and with robust bookings anticipated for the second quarter, there remains risk of a possible recession. For Montana, that means “we will continue to size the airline for the resources we have with a focus on reliability and sustained profitability.” While capacity is expected to be up 5% to 8% year-over-year, that is 95% to 100% of 2019 levels so supply and demand imbalances may offset a more difficult macro environment.

The difficulty with this environment is the unknown impact of a US recession on the airline industry. Montana points out that since 2008, US carriers have consolidated and after the intense pandemic period are better able to deal with exogeneous shocks. “We have learned to navigate the thousand-year flood scenario and we have many more tools at our disposal such as assets we can finance, markets we can tap into to cut costs, and the ability to move networks rapidly,” says Montana. “We are a very different industry and are better equipped to deal with whatever comes our way this year. And the excess liquidity gives us a lot of flexibility and we are much further along the way in our $15bn debt reduction journey than we expected at this point.”

Responding to concerns that the “Covid bounce” or pent-up demand may be coming to an end, Montana remains confident that desire for travel remains and that there has been a long-term change in the way we work and travel that will keep demand buoyant. “This is the first summer that Europe is fully uninhibited with travel restrictions, and we are seeing more transatlantic travel in our forward bookings. But there is also a whole new world of working more flexibly with more people extending business trips blended with leisure. Hybrid working provides people with the ability to take a four-day weekend to further destinations that creates a different travel pattern. For example, previously it might have been too expensive or unrealistic to take your family for a weekend down to Mexico, but making it a four-day trip helps to justify that cost.”

There has been some debate too over the slow return of business travel, which may be further constrained during a recessionary environment. However, Metz also sees a change in business travel patterns. “We’re well on our way to a fully recovered business, but we aren’t there yet,” he says, “but there has been a change in the travel patterns of the road warriors that fly into and out of a city on the same day. Because some people aren’t in the office every day anymore, they are becoming more thoughtful when planning business trips. Pre-pandemic you may have flown to a city for several days of meetings but if clients aren’t in the office for five days, that may now translate to two separate trips. There is also much changing, with more blended travel, shift from a peak time flight to a trough time flight which reflects changes in work schedules through the week and more discretionary trips.”

The treasury team and new CFO Devon May are well underway with carrying out their mandate to reduce debt and put the airline on a more balance approach to capital. American’s view is that its first-quarter results show that this approach is working.

American produced revenues of $12.2 billion in the quarter, a record for the first quarter and an increase of 37% versus the first quarter of 2022 on 9.2% more capacity. This helped contribute to net income of $10 million in the first quarter on a GAAP basis and a first-quarter profit for the first time in four years.